Misconceptions, opportunities and strategic rethinking

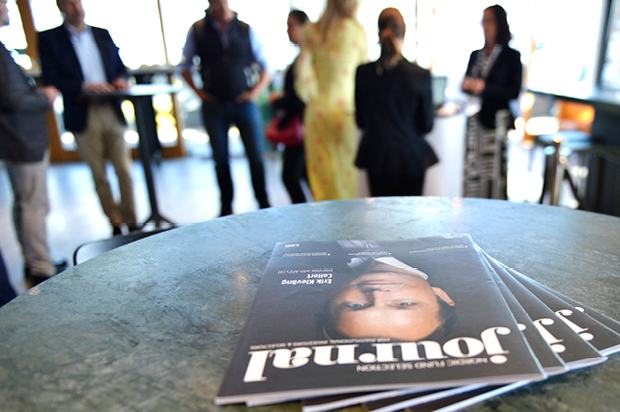

In June, Tell Media Group, in cooperation with East Capital and Eastspring Investments, organised a roundtable discussion at Operaterrassen in Stockholm with Swedish investors, focusing on Chinese equities. Tell Media Group founder Niklas Tell and Nordic Fund Selection Journal editor Caroline Liinanki moderated the discussion.

The discussion started out with Caroline Liinanki asking how to approach China as an investor and what role China should play in an equity portfolio.

MARCUS SVEDBERG: “I think the answer to that question has changed compared to a couple of years ago. A lot of things are happening in China and around the world that merits a re-evaluation of our exposure to China, such as geopolitics and economics. I haven’t seen many public statements from Swedish institutional investors about reallocations when it comes to China but I think a lot of asset owners are currently thinking about these issues. My sense is that for many years investors were on a quest to increase the exposure to China and it was more a question about how best to get exposure. This was also part of the globalisation discussion and when globalisation was increasing China was a very big part of that. Now there’s talk of deglobalisation, even if I haven’t seen it in my research, and that also points to the need for a re-evaluation. I’m not saying that we should reduce the exposure to China but we need to re-evaluate. The result of that re-evaluation can, of course, be to keep the current exposure.”

CECILIA SVED: “I think those are valid points. But we should also keep in mind that a lot of investors are very benchmark aware and from a benchmark risk perspective, it’s very expensive to exclude China.”

PONTUS VON ESSEN: “I think it was back in 2017 when I for the first time heard the animosity between US and China from US investors at a conference. China was then starting to be seen as a competitor and at the time, we still thought that Europe could decouple from that. But after Covid and with the recent changes in the security discussion in the world, it’s clear that’s not the case. The US and China are going in different directions in many aspects and as a European allocator, you have to think about what that means and the security changes in Europe have only increased that need. We’ve seen what’s happened with the war between Russia and Ukraine and we need to keep that development in mind as we think about China and Taiwan. We haven’t changed our allocation to China but if we before Covid were thinking about increasing the allocation, that’s no longer the case.

NIKLAS TELL: IS THIS A SIMILAR THINKING TO WHAT YOU HEAR FROM INVESTORS ELSEWHERE?

KEN WONG: “I’ve been on the road now for a while and many investors highlight the same uncertainties, not least with regards to the regulatory crackdowns we’ve seen over the last couple of years around technology. But that’s also how China operates. Also, if you look long term and then I mean 10 to 15 years, China is something you can’t ignore as an investor. Cecilia mentioned benchmarks and it’s a fact that China will only become a bigger part of global indices with more listings and bigger free floats. The question is what to do in the short term. A lot of investors have been disappointed with regards to their China exposure in the last couple of years but there are opportunities, especially in A-shares where international investors are underrepresented at the moment. I also think it’s important that investors are now again able to travel to China and be able to see with their own eyes what’s going on.”

CAROLINE LIINANKI: WHAT ARE SOME OF THE KEY MISCONCEPTIONS WHEN IT COMES TO CHINA AND THE CHINESE STOCK MARKET? DO INVESTORS KNOW CHINA AS WELL AS THEY SHOULD?

FRÉDÉRIC CHO: “The short answer is no. I’m, of course, a veteran and saw the birth of the Shanghai stock exchange while being a representative for Handelsbanken, so I’ve been working in and with China for some 30 years now. It has matured since then but what has stayed with me since the start is the importance of granular stock picking and really understanding individual companies. One misconception relates to the Chinese currency and the fact that it’s not fully convertible, which of course is why we have A-shares and H-shares. We must also be aware of the fact that China is a political economy. It’s partly market economy and partly state economy and it very much depends on the sector you’re looking at. In general, we all need to learn more."

HAO ZHANG: “I agree with Frédéric – we need to learn more. China is a different market in terms of how things work and the government is very involved when it sees something that it doesn’t think is good enough. The crack down on education companies is just one recent example. It’s therefore important for us as investors to really try to understand what the government is focusing on and how it’s trying to shape the economy. That will provide headwinds and tailwinds. We’ve also seen the importance of local insight where one example is the volatile development of the Hang Seng index, which rallied a lot from October last year until earlier this year when it crashed. The local market didn’t have the same movements and the reason for the difference was that international investors were very optimistic on the reopening of China whereas local investors were more conservative and expected a slower recovery.”

MARCUS SVEDBERG: “Ideally, these are the conversations I want to have on all markets – gaining real insight on the developments in the economy and society. However, that’s not where we are when it comes to China. Now, it’s not primarily about how we want to gain the exposure but if we want to have the exposure at all and it has less to do with performance. It’s not a tactical decision but rather a strategic decision. Over the last couple of months, I’ve been at a couple of global strategy sessions and different strategists have said that they are bullish on China tactically but then the first question they get relates to geopolitics. You normally don’t trade geopolitics tactically – it’s a strategic decision. Also, all of this is made more difficult by the fact that we haven’t been able to travel to China for three years.”

The roundtable discussion was published in issue 04, 2023 of Nordic Fund Selection Journal. A PDF of the complete story can be found here.

//Participants

- CECILIA SVED, Asset allocation and strategic analysis, AMF

- PONTUS VON ESSEN, Head of strategy, AP7

- MARCUS SVEDBERG, Chief economist, Folksam

- FRÉDÉRIC CHO, Founder, Frédéric Cho Advisory

- HAO ZHANG, Assistant portfolio advisor, East Capital

- KEN WONG, Client portfolio manager, Eastspring Investments