Analysing net-zero targets and understanding physical risk

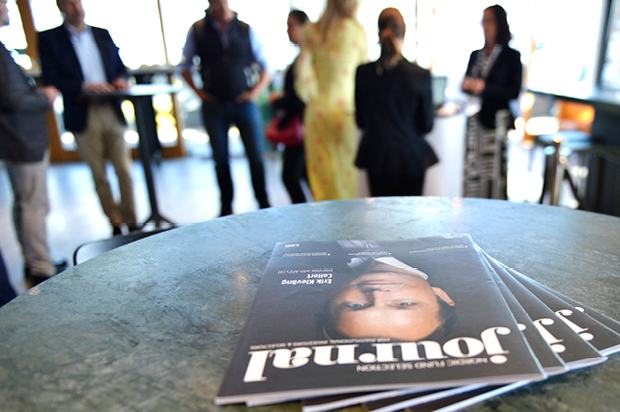

Earlier this fall, Tell Media Group, in cooperation with BMO Global Asset Management, Federated Hermes and JPMorgan Asset Management, invited Finnish investors to discuss climate change risk and opportunities. Tell Media Group founder Niklas Tell and FBNW editor Janina Sibelius moderated the roundtable.

The discussion started out with Janina Sibelius asking the investors how they have been working with climate change from a more strategic portfolio perspective.

HANNA KASKELA: “Varma introduced a climate policy for investments in 2016 and this was renewed in 2019 where we extended the policy to cover every asset class. The overall aim is to be carbon neutral by 2035, which is also a goal for the Finnish government. We have specific targets for listed equities and bonds on cutting the carbon intensity and a roadmap for how to get there. Then we’re also trying to figure out who the beneficiaries will be going forward, which is sometimes missing in these discussions.”

MIKA LESKINEN: “It’s a little bit different for us as a fund company as we don’t have one single portfolio but several different ones. I therefore find it a little bit difficult to say that by 2030, our CO2 emissions will be 30 per cent below the current level because if we were to set a target like that, it could limit our product development in areas where emissions are higher. That’s just one aspect. We have mainstream products where we tackle climate change through ESG integration and we also exclude stocks like mining companies if the share of thermal coal is above 20 per cent of revenues. That threshold will be lowered to 15 per cent by the end of 2022 at the latest.”

ANNIKA ESONO MANNINEN: “For us, there are, of course, similarities with what has already been said. Our overall goal is to be net zero by 2050 the latest. We also look for managers that use bottom-up research to steer portfolios in the right direction, even if we also have certain limits and exclusions, for example on coal. For a long time, we’ve been able to do carbon analysis on a certain part of assets and we’re working on how to widen that to cover everything in order to work with our clients and understand what type of products can help us and our clients in reaching carbon neutrality.”

NIKLAS TELL: WOULD YOU SAY THAT IT USED TO BE THAT IF YOU FOCUSED ON THE “G” IN ESG, THEN THE “E” AND “S” WOULD PROBABLY BE OK? HAS THAT CHANGED AND ARE YOU NOW FOCUSING ON THE “E” FIRST?

CAROLINE CANTOR: “We have an engagement team at Federated Hermes that provide stewardship and engagement services to a number of the largest pension funds and institutional clients. Initially, a lot of the engagement was around governance topics, but we’re now changing our framework because we think having good governance is the basic standard you need to have in place to be able to have true engagement around other topics. In that sense, encouraging good governance is a necessary step to be able to engage effectively on other significant topics, like the approach to climate change. For example, we encourage things like senior management remuneration being linked to environmental and social improvements.

VICKI BAKHSHI: “We survey our engagement clients every year to ask about their top priorities and consistently over the past two or three years, climate has risen to the top of that survey. It’s definitely the issue of main concern for our engagement clients, as well as a topic of many of the questions coming in from our fund clients. I think, however, that there’s an increased focus on the governance aspects of climate change. We incorporate climate change systematically into our voting processes and we use our voting as a tool to engage on climate change. So we’re sort of bringing the ‘E’ and the ‘G’ much closer together.”

JENNIFER WU: “The way we think about climate has evolved over time because climate risk is investment risk. Also, climate change is not only about transition risk. It’s also about physical risks. If you think of the ’S’ in ESG, Covid was a great example of this. Companies that were good at taking care of their employees fared pretty well compared to some of those that didn’t and I think it’s the same with climate. With more extreme weather events, you need to consider where your employees are located and their commute to work. We’re starting to have conversations about how companies are managing these climate related risks. Regarding the governance aspect, I very much agree with what Vicki said. We’re not only looking at the diversity of the board in terms of gender but also if they actually have the expertise to manage these risks. So for us, climate change is not isolated in the ‘E’ but it basically cascaded across ESG.”

The roundtable discussion was published in issue 06 of Nordic Fund Selection Journal and a PDF of the complete story can be found here.

// Roundtable participants

- ANNIKA ESONO MANNINEN, Head of ESG at OP Asset Management

- MIKA LESKINEN, Chief investment officer at S-Pankki

- HANNA KASKELA, Director of responsible investment at Varma

- VICKI BAKHSHI, Director, governance and sustainable investment team at BMO Global Asset Management

- CAROLINE CANTOR, Investment director at Federated Hermes

- JENNIFER WU, Global head of sustainable investing at JPMorgan Asset Management