Expectations, ESG materiality and manager selection challenges

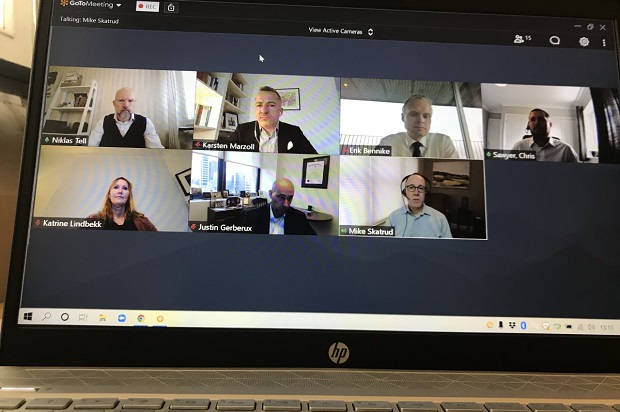

In March, Tell Media Group, in cooperation with Barings, T. Rowe Price and MFS Investment Management, invited Nordic investors to discuss high yield investing. Tell Media Group founder Niklas Tell moderated the roundtable.

The discussion started out with Niklas Tell asking the participants why you should have a strategic exposure to high yield and what they expect from the asset class going forward.

ERIK BENNIKE: “For us, it’s a strategic allocation as we think it will provide decent risk-adjusted returns for the long run. We run a defined contribution scheme with a life-cycle strategy, which allows us to allocate various parts of risk to different age cohorts. While young people can bear a lot of equity risk because they will have a long time to recoup potential losses, we think credit in general fits pretty well with the older members. We base that on the assumption that any potential losses would typically be recouped relatively fast. That has been the historical experience and I would think that probably will be the case in the future as well. We have, of course, been helped by falling interest rates for quite some years, so there might be a slightly longer wait until any potential losses might be recouped in the future. But with yields going up, which is the consequence of falling returns, then there’s the mathematical truth that the coupons themselves would allow you to recoup losses if you just have patience.”

KATRINE LINDBEKK: “The arguments from our side are fairly similar and we also think that high yield has attractive asset allocation benefits. Gjensidige is non-life insurance company and fixed income is a substantial part of our allocation mix. We see high yield as being slightly less sensitive to rate moves compared to our investment grade allocation, so it can be a good fit to have a strategic allocation to high yield in a diversified portfolio. From time to time, it might be more or less attractive and then we might add to or reduce our weightings. Yields are pretty low now in high yield by historical standards and spreads are not particularly high. I would say we’re in a holding period of waiting and seeing.”

JUSTIN GERBEREUX: “High yield is one of the only places to get income today. I think some 27 per cent of global fixed income has negative yields today and with the global high yield index, you get a current income of some 6 per cent. It’s also a reasonably diversified asset class and roughly only 12 per cent of the asset class was affected by Covid. In terms of diversification for portfolios, it remains one of the higher Sharpe-ratio asset classes. In terms of drawdowns, the worst drawdown in the last 20 years for global high yield was 38 per cent, while it was around 80 per cent for global equities. So you do have some downside protection as well.”

MIKE SKATRUD: “Not all high yield is created equal, however. Asset owners have options, for example when it comes to regional allocation. Our global high yield strategy includes the US, Europe as well as emerging markets. Some investors want the emerging market exposure and others don’t. On top of that, you can move up and down the quality spectrum, so I think it’s really about matching your strategy with the objectives of asset owners.”

CHRIS SAWYER: “I would like to pick up on Katrine’s point around where spreads are today versus historical levels. If you look at high yield today, you’re not comparing apples for apples with high yield from 10 years ago. There has been a pretty big seismic shift in the composition of high yield over the last five or six years to better quality, bigger and more established companies. That, of course, gets reflected in spread levels, because your credit risk is reduced compared to the high yield market of the pre-Lehman era, where it was almost the market of last resort for a lot of borrowers. A spread of 350 bps today is not necessarily representative of a spread of 350 bps some 10 years ago.”

The roundtable discussion was published in issue 02 of Nordic Fund Selection Journal and a PDF of the complete story can be found here.

//PARTICIPANTS

- ERIK BENNIKE, Head of credit investments at PensionDanmark

- KATRINE LINDBEKK, Senior portfolio manager at Gjensidige

- KARSTEN MARZOLL, Senior fund analyst at SEB

- CHRIS SAWYER, Leveraged loan and high yield portfolio manager at Barings

- JUSTIN GERBEREUX, Director of research in the fixed income division at T. Rowe Price

- MIKE SKATRUD, Fixed income portfolio manager at MFS Investment Management