The lasting impact on asset manager/investor relationships

While many Nordic sales staff miss the personal interactions with investors, new ways of communicating and maintaining relationships are gaining ground – and are likely to change things on a more permanent basis.

The restrictions around travelling and face-to-face meetings have created serious disruption in the relationship between asset managers and investors over the past months. The usual interactions in terms of office visits, seminars and events have since mid-March been put on hold for an indefinite period and replaced by communication over phone, email and video. While Nordic investors and fund selectors have had their own set of challenges, those working on the Nordic sales side have probably experienced the biggest changes to their day-to-day work as their globetrotting lifestyle has come to a sudden halt.

Gaining access to Nordic asset owners and fund selectors has always been tough and the global pandemic has moreover removed any opportunities for spontaneous meetings during conferences and seminars. The difficulties of the current situation are reflected in our survey of close to 40 asset management sales representatives on the future of the Nordic sales role, which was conducted in May. In an open question about the biggest challenges at the moment, one quarter of respondents specifically mention the absence of face-to-face meetings and even more mention a general lack of access to clients. As many have had to get used to communicating digitally, there are also hints that the meetings that do happen are of lower quality.

Commenting on the new ways of meeting investors, Senait Asgede, senior client director at Schroders, says: “You can have regular interactions with clients to get an update and to listen to what’s going on at their end over a conference call or video. We will need to learn how to do it but I think creativity might be challenged in the beginning. It’s easier to have an open discussion and brainstorm when you meet face-to-face.”

Since restrictions were enforced in March, investors’ needs and priorities have changed during the course of the spring, both driven by the nature of the crisis and the market behaviour. “This is a tragic health crisis, which is why the response from us and our customers have been driven by the individual needs,” says Lena Lundholm-Micko, head of Nordic institutional sales at Blackrock. “Many of our clients have had to handle the needs of their employees, their families and friends as well as the professional responsibility. At the beginning of the crisis, many organisations were also focusing on how to move the operations from the offices to working from home. The health concerns were then quickly accompanied by navigating a market shock.” That, she says, sparked a high level of activity with clients, a great deal of investor attention around liquidity and an enormous need for information. More recently, she says conversations have moved on to more future-looking strategic discussions around asset allocation and portfolio resilience.

François Xavier Douin, client advisor for the Nordic institutional business at JPMorgan Asset Management, spent most of the initial period of the crisis on reassuring existing clients and extinguishing fires. “There was first a panic time when clients were too busy to speak and then a second phase, when clients have been a bit more available. When the dust settled, they have been more willing to discuss other things,” he says. In fact, it turns out that there are some advantages with the current way of working. “The working days are longer since there’s no commuting time, so clients have been quite keen to speak,” François Xavier Douin adds. He also mentions the increased flexibility in organising meetings that comes with not having to rely on Nordic investors being available during specific days when visiting a city with a portfolio manager.

Lena Lundholm-Micko agrees. “I think to some extent both we and our clients are more available. You don’t need the extra time to travel between meetings and it’s positive that meetings can take place on a more flexible basis,” she says, adding that virtual communication has worked well and is a tool that has been used for some time at Blackrock. In general, it would be fair to assume that large asset managers have been better equipped to handle the new environment due to bigger and better resources at hand. Lena Lundholm-Micko notes that Blackrock’s technology platform Aladdin has facilitated making the transition towards working digitally at the firm as well as for its clients.

This spring has otherwise seen an explosion in the amount of webinars hosted by asset managers. However, it seems to be a difficult format for reaching investors. One survey respondent commented on the current overflow of information by stating: “Everyone offers the same: webinars and video conferences with managers. The market is even more crowded now than before.” As a tool for interactions, it also has some shortcomings. “You can’t build relationships through webinars. Even if they like the content, you will just be a service provider among others,” says François Xavier Douin.

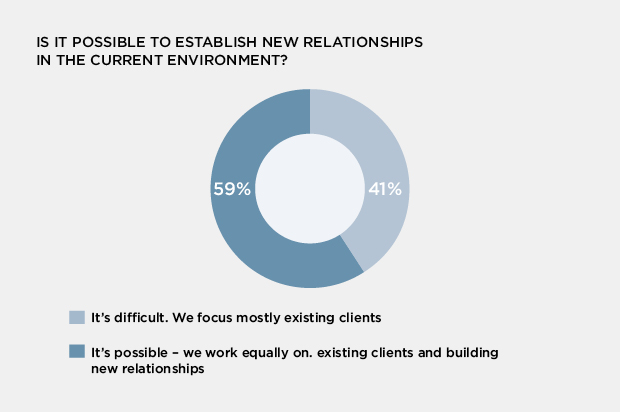

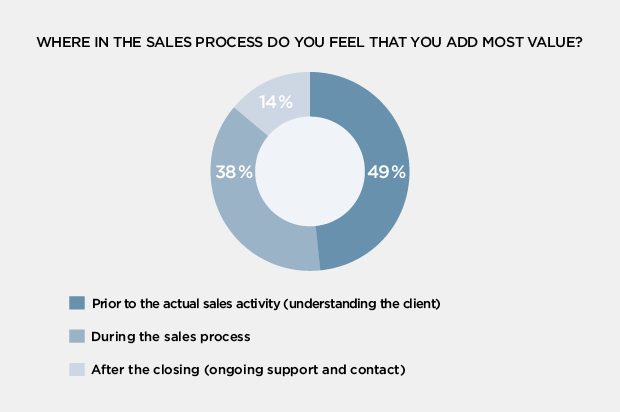

Another challenge mentioned by many is “lost opportunities” as investors are focusing more on current investment and are changing their priorities away from new searches. One person in the survey comments that topics that were discussed before have been postponed and are currently off the radar due to other topics gaining priority. Furthermore, the lack of personal meetings may create difficulties in building new relationships. Some 40 per cent of survey respondents say that it is difficult to establish new relationships at the moment and that they therefore focus mostly on existing clients. Senait Asgede observes that having a video or conference call is often more successful with existing relationships. “It’s much harder to create a relationship and to connect with people over the phone or a video conference. At the end of the day, we’re humans and we want to have the touch and feel before we can be comfortable about a person or a company,” she says. She also believes that it is likely to become more difficult for companies wanting to enter the Nordic market going forward if traveling is being restricted. François Xavier Douin adds: “A lot of what we always wanted to do in person can probably be replaced by video calls. Even strategy-related discussions, where you have an open agenda and discuss strategy, priorities and the future of the firm, can be replaced by calls if it’s with someone you know well.” On the other hand, he observes that pitching a very complex new product will probably still require face-to-face meetings as well as those that imperatively have to take place at the manager’s premises to include more people than those that would typically travel.

If communication with clients and prospective clients becomes more digital, Senait Asgede observes that it will also have to become more specific. “We will have to be more to the point and all the social discussions and the ‘soft part’ will be reduced because clients wouldn’t have time for that kind of discussion going forward,” she says, adding that it would be more efficient but that you would lose some of the heart and soul of sales. Nevertheless, Henrik Jonsson, country head for the Nordic region at Schroders, expects many of the current features of working life to remain in place when restrictions are lifted. “This is not just a couple of weeks. We’re spending a lot of time working from home across the globe. Once you start doing it to the magnitude we’re doing now, you really start to understand how you can adapt yourself and how you can be more efficient. I do think there’s reason to believe that we will continue doing some of these things also when restrictions have been lifted,” he says. He adds that reduced travelling, even within the Nordic countries, will likely be part of the new future and highlights the climate change aspect. “A lot of companies have already started looking at their carbon footprint and reduced travel budgets would be in line with that. These things are happening and they will obviously now happen quicker. We’ve had the tools to facilitate digital meetings and conferences for a long time but we were used to doing business in a certain way. Now we’ve been forced to change and we can see that digital meetings are working,” he says.

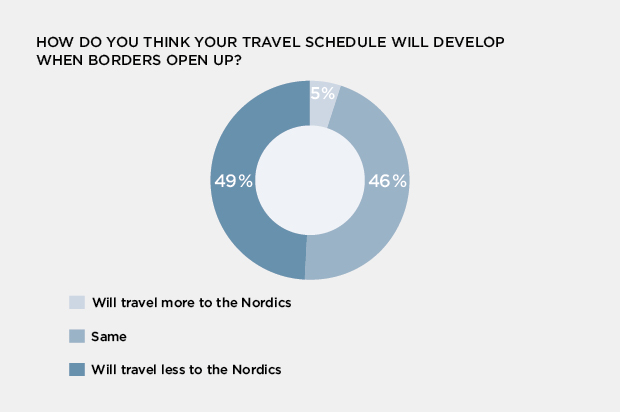

Many sales staff may, however, be in denial about the more permanent impact – or perhaps it is just a matter of wishful thinking. Almost half of the survey respondents expect their travel schedule to be back to what it used to be when the current situation is resolved. And about 5 per cent of survey respondents expect to start traveling even more than they used to. At the same time, almost all respondents recognise that there is likely to be more video meetings happening in the future.

“We all like to complain about late flights and waking up early but we do miss some of the traveling,” François Xavier Douin says. “But I don’t think our clients miss it as much as we miss it.” Nevertheless, he expects some dramatic changes to his own travel schedule in the post-pandemic world. “I don’t think the quantity of interactions will change but the delivery will. In the first year after the Covid lockdown, I would think my traveling will have been reduced by more than half,” he comments.